One hundred and forty one: World Financial Crisis

Mark: Hello and welcome to the EnglishLingQ Podcast. Mark here with Steve. Hi Steve.

Steve: Hi Mark.

Mark: I'm trying to remember who asked us to talk about this topic, but we were asked to talk about the world financial crisis; I guess it's very timely.

Steve: I think it's a good idea to talk about things that are topical of interest. So, again, one of our themes is if you can listen to or read content that's of interest to you you're going to learn a lot better than if the content is of no interest. So what can we say? Today the U.S. Congress voted down the most recent Bush proposal for a bailout, a massive injection of government financing to bail out the financial sector. I gather that there's a lot of feeling out there that the clever people on Wall Street who created this mess should pay for it themselves somehow, but I guess the problem is that if the government doesn't bail out some of these financial institutions that there isn't enough money around to keep our financial system going and that could cause a major economic recession.

Mark: And I guess not just an economic recession in the States, but it's a global issue. Even today we saw after that announcement that a number of European banks had to be rescued by their own governments, bought out or propped up. I don't know exactly what happened there, but they had the same problem that they've been having in the States where the government in the States…either the government or with the help of government other companies have stepped in and taken over and propped up failing investment banks.

Steve: But I think the underlying…people say, how could this happen? I think the underlying problem is a five-letter word called “greed”, g-r-e-e-d “greed”.

Mark: Yes.

Steve: People like to perhaps make out that this is an American problem, but there were lots of foreign banks who knew exactly what was going on. Even foreign investors; I heard that the Norwegian Pension Fund and I know there were pension funds here in Canada who bought what they should have realized were very risky, you know, credit instruments simply because they had a high yield.

Mark: Well, I think because it's probably harder and harder to find high-yielding safe investments given the low interest rate environment that we've had for a long time. Obviously, I think it's a situation where those investment bankers are sort of far enough removed from the original lender, the guys who actually loans the money to essentially the people that can't pay, the unworthy customers, but then all those subprime loans get bundled together and sold off to one guy who then sells them off to another guy. By the time they get to the investment banker he probably thinks that somehow it's been turned from something that's really kind of risky into something not risky by the time it gets to him and, obviously, at some point they didn't do their research.

Steve: Well that's the point.

Mark: And they just kind of…it's almost like I'll hold my nose and everybody says it's not risky, so maybe it's not risky. Okay, I'm fine.

Steve: But therefore they didn't do their job.

Mark: Absolutely.

Steve: So there's no excuse. But if we go right back to the beginning, the first step in all of this -- and I think there has been a desire in the United States even going back to the Clinton years – is to make, you know, home ownership more accessible to people who don't have a lot of money. And so, again, I haven't…we did a bit of research on this, but I don't know when this all started. But, insofar as the subprime loan is concerned, what the practice was was that people who would not normally qualify for a housing loan were given a housing loan. What's more, even people who would qualify for a housing loan, I've heard from personal experience, they were encouraged to borrow more than the value of their house. So they were given what was called “adjustable rate mortgages” so that they would only pay one or two percent for the first two years and then they would have to pay the full interest rate in subsequent years. And so here you have them being encouraged to borrow more than they need. They can't even afford to pay for their house let alone something more than what their house is worth. But, of course, in the United States we've had a period of ever-increasing housing prices; from the year 2000 to the year 2006 housing prices rose by 80%. So they would be told by the lender, you know, don't be a fool. This is easy money. You can borrow more. You can borrow it at these low interest rates. The value of your house will go up so you'll be able to pay for it.

Mark: Right.

Steve: And so that's kind of where it started.

Mark: And from the lender's perspective, well, even if these people can't make their payments I'll still have the house. The house will increase in value. My capital should be safe. Which is fine as long as prices keep going up, but, obviously, as we've seen in the States in the last two years, prices have come off significantly and so people are left owing more money than their houses are worth, at which point they walk away. So that's, obviously, one of the problems, but I guess a bigger problem is these products, whatever they're called, the subprime investment…

Steve: Well, I don't remember the…

Mark: I don't know the official term for the package that they promote to the investment bankers, but all of a sudden people realize that these aren't worth very much and they have to write them off at a certain rate. For that reason…I can't remember exactly why, but because they're not worth much, they can't sell them and then it affects their balance sheet and their stock price.

Steve: Well that's right. The two things that I've been able to identify is, one, this derivative and I think that's a word that's come up a lot is “derivative”.

Mark: Right.

Steve: These are very sophisticated sort of instruments of financing where you can bet on a hedge. It's all about hoping that the worst doesn't happen.

Mark: Right.

Steve: And so this one instrument is called a “Credit Default Swap” derivative, a CDS.

Mark: Right.

Steve: And I don't fully understand it, but it seems to be that if you have a bunch of loans and you go to an investor and you say, here, you can pay me X amount of money and you will earn all these premiums and everything is going to be fine. However, if some of my loans default then you have to cover me. And so as long as there's only a few loans that default…

Mark: Right.

Steve: I presume the return on those is quite high so that the banks are happy.

Mark: Right.

Steve: But when you start getting a decline in the housing market and we go back to the guy we talked about who can't even afford to buy a house and has now taken on 20% more loan than his house is worth at a subsidized interest rate and all of a sudden has to pay the interest rate and he defaults and more and more of them default. So all of a sudden we don't just have one or two loans defaulting, we've got lots of loans defaulting. And for some reason that I don't fully understand this Credit Default Swap has greatly sort of exacerbated the problem. Warren Buffett…

Mark: The Credit Default, is that not just a name for that type of investment product? Like in the case that we're discussing it was the subprime mortgages. That's a type of whatever you called it…

Steve: Right.

Mark: Credit...whatever it was.

Steve: The Credit Default Swap is a derivative.

Mark: It's a derivative, but the subprime loans is one type of Credit Default Swap. Like if you had credit card…

Steve: The subprime loan, per se, is not a Credit Default Swap.

Mark: No, but that's…

Steve: It gets packaged into this range of loans…

Mark: Right.

Steve: …which an investor bets…

Mark: Right.

Steve: …that a high percentage of them are not going to default and he'll walk away with the interest.

Mark: Right.

Steve: So it's a very speculative thing.

Mark: All I'm saying is that this Credit Default Swap product will focus on real estate, well, mortgages…

Steve: Right.

Mark: …or there'll be one that deals with credit card debt or some other kind of debt and so investors buy these hoping, as you say, nothing bad will happen.

Steve: Right.

Mark: But I guess the tipping point was when housing prices started to decline significantly.

Steve: Right.

Mark: So all of this stuff was predicated on the belief that the housing prices will always go up.

Steve: Things can always improve or can only improve.

Mark: Can only improve.

Steve: But it's interesting that Warren Buffett, who's one of the richest men in the world and who made all his own money by simply being smart…

Mark: …in investments.

Steve: And who, by the way, was turned down by the Harvard Business School and he calls that a turning point in his life.

Mark: Right.

Steve: He went to Columbia instead, but he identified like four or five years ago that all of these derivates and particularly these Credit Default Swaps, he called them “weapons of financial destruction.”

Mark: Mass destruction.

Steve: He said there would be very severe consequences and he stayed completely away from them. He is now busy buying financial institutions because there is the point of view that, in fact, things are not as bad as they are presented and there are some accounting regulations that force the banks to put a value on some of their assets, which is perhaps today's market value, but which doesn't reflect the real potential value of those and so he's betting that he can select those banks that are okay.

Mark: And insurance companies because the insurance companies were big into this stuff too.

Steve: Right.

And one of his quotes, which I think is really neat, is he says “Life is like a snowball. If you want to grow the important thing is to find wet snow and a really long hill.” In other words, you accumulate your wealth gradually. There is no sudden, strike it rich, high return, no risk. There is no high return with no risk.

Mark: Right.

Steve: So he prefers to find wet snow and a really long hill. Find good companies, invest in them and stay there.

Mark: Exactly.

Steve: Whereas I think a lot of these fancy financial instruments that people were speculating on is more like a snowball that falls over a cliff and you hope there's a soft landing down there, you know.

Mark: Yeah, no, it's certainly a problem that's affecting global financial markets and the global economy. Well, I mean depending on who you listen to or who you hear speak it's either, hopefully, going to fix itself soon or could go on for quite a while and continue to get worse. You know the stock markets today took a big tumble after that announcement in the U.S. Congress where they did not pass that rescue package. I mean who knows; maybe something else will come along.

Steve: My guess is that they will pass a package.

Mark: I'm sure they will, yeah.

Steve: I think too, I'm always one…perhaps I'm a bit optimistic by nature, but I think some of the good that will come from this is that I think there has been far too much speculative activity in the United States. Even a homebuyer, an individual, who buys a home that he can't afford and takes a loan on that he can't repay because the interest is low and because he hopes the house is going to go up in value, he's a speculator.

Mark: Absolutely.

Steve: He's just a speculator throughout the whole package. I think the United States has been addicted to credit; individuals who are heavily in debt through their credit card. Of course, people push products at them and push financing at them and these people are speculators. I think what has to happen is, hopefully, people will step back and say, everyone has to try to live within their means. You don't need a bigger house have a smaller house, ride a bicycle. You know you can live your life quite happily without having all these goodies.

Mark: I think it's also important to mention that it's not just the United States…

Steve: No.

Mark: …that's been living beyond their means. Certainly here in Canada it would be similar.

Steve: Similar and in Britain.

Mark: And in Britain and I don't know about Europe or Asia, but I mean once real estate prices start coming off here and they will, then we're going to see similar problems here, I have to believe. You know a few years ago, you know, I can't remember who said it, but the quote was something like when your barber is talking about investing in something that's the time to get out.

Steve: Yeah.

Mark: I know here people were buying second homes, investment properties; have been buying, you know, for the last five-six years as investments.

Steve: Right.

Mark: Like everybody. Not just a few people, but everybody's talking about trying to buy a second home…

Steve: Flip a home.

Mark: …flip a home, buy a condo downtown. I mean I don't know this for a fact, but, anecdotally, apparently a lot of the apartments downtown in downtown Vancouver are owned by either absentee owner, speculative, second apartments. They're vacant, you can't rent, all those kinds of things. I mean it can't go on forever.

Steve: No.

But, you know, to put all of this in perspective, the reason I mention the United States is because they are such a huge market. So that by them being addicted to credit and addicted to buying things -- we in Canada too, but we're 10% of the United States -- this has spawned tremendous wealth in other places like the Middle East for oil, like China and other countries that produce consumer products that the Americans want.

Mark: Right.

Steve: So these countries now end up hanging onto these dollars and hoping that the addicted American consumer will continue buying these things so that they can continue running their factories.

Mark: Right.

Steve: But the positive side is that there is a lot of wealth in the world. There is a lot of wealth in China, in India, in Taiwan and now increasingly in places like Brazil and Russia. There is a lot of wealth and we have had a lot of technological innovation, a lot of new products. In many ways I think…like the Internet has brought tremendous benefit to a lot of people; education, entertainment, access to information, ability to communicate with friends and so forth.

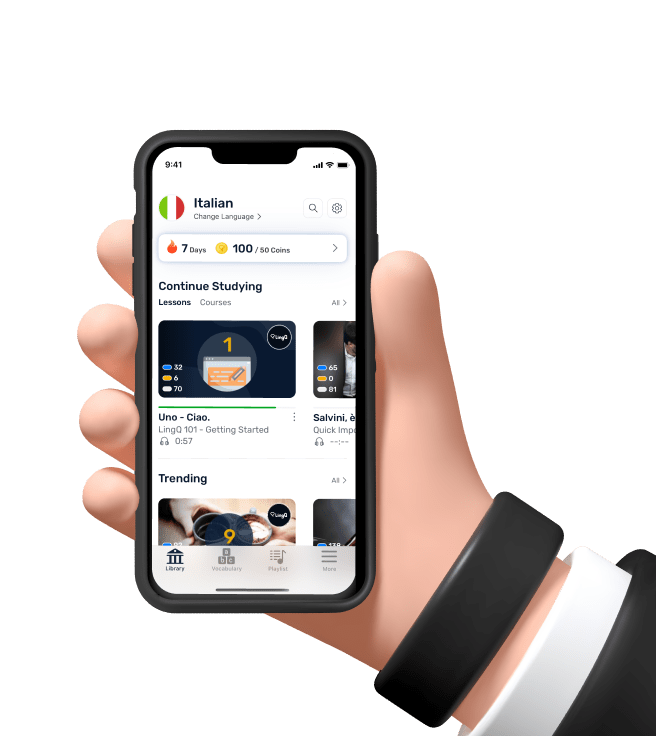

Mark: Most importantly language learning.

Steve: And language learning on LingQ. Hey, absolutely, absolutely. So I'm positive about the world in general and I think the world has become closer-knit. If people will only learn to speak each other's languages using LingQ they'll like each other better and at the same time they've got to stop this speculative, greedy, type of behavior.

Mark: Well and I think…I agree with you, I think they'll pass some kind of bill in the States. But, I guess from another perspective, I guess a lot of people are thinking maybe let everything crash and let all those people find themselves out of a job. Maybe that will bring the financial system back stronger rather than to just prop it up and let those people continue to come up with new investment strategies.

Steve: Well you know it's so difficult. It's so difficult because you say, okay, the people who are deciding our fate are politicians and when you look at some of the motives here where the Republicans say they voted against it because the Democrats, in urging people to vote for the bill, accused the Republicans of having, you know, spoiled the economy, blah-blah-blah.

Mark: Right.

Steve: So they took this opportunity of this, supposedly, you know, very strategically-important vote as an opportunity to bash the other political party.

Mark: Right, yeah.

Steve: I mean I'm sure that the Republicans did the same back at them.

Mark: Right.

Steve: So the other thing is, of course, human beings are pretty imperfect creatures.

Mark: Yup.

Steve: We love to bash the politicians; they're no better or worse than the rest of us. Yeah, hopefully we can find a way, a practical way to resolve this. And you say to yourself, okay, well if you don't trust the politicians who are you going to trust the experts? Well presumably the experts were running our financial system.

Mark: Right.

Steve: So, you know. I have ranted long enough about experts in language teaching and how we feel that there's a better way with LingQ. So, hopefully, a combination of common sense and experts and fear will lead us towards…

Mark: Yeah.

Steve: We'll know better in a week from now.

Mark: Yeah we will, for sure; although, I think all of this stuff can continue on for quite a while. Maybe we'll be talking about it again in another few months.

Steve: Well you know before you shut us down there Mark, the point is here you are… you and I have talked about this financial situation, we're not experts, we don't understand it very well…

Mark: No.

Steve: …but we were able to use some of the terminology.

M; Right.

Steve: So that, hopefully, that helps people in their English language learning.

Mark: Exactly.

Steve: We look forward to hearing more requests for subjects that we can talk about.

Mark: That was Maryann, by the way, who asked for that.

Steve: Thank you Maryann.

Mark: Thanks Maryann for your feedback. And anyone else out there, if you'd like to hear more about a specific subject just let us know; come onto LingQ and post it on the EnglishLingQ Forum. Okay, we'll talk to you later.